Summary

The objective of this proposal is twofold:

- List the wstETH/WETH.axl LP token as collateral and launch the related High Leverage Strategies (HLS):

- wstETH/WETH.axl LP token collateral with WETH.axl debt;

- wstETH/WETH.axl LP token collateral with wstETH debt

- Decrease the deposit cap for WETH.axl on the Neutron outpost of the Red Bank (from 200 to 100)

where:

- wstETH is a liquid staking derivative (bridged through the canonical Lido bridge);

- WETH.axl is the Axelar Wrapped representation of ETH

Motivation

The wstETH/WETH.axl pool has sufficient liquidity on Astroport (~1M$) and this LP token is incentivized by Axelar rewards to promote wstETH adoption in Cosmos chain which allows to get around 10% APR including incentives. As such, we think it could generate considerable organic demand for the Mars Outpost on Neutron.

Furthermore, in addition to listing the LP token, we’re also proposing the addition of High Leverage Strategies (HLS) markets, a popular type of strategy that gained significant traction. HLS could yield high returns with leverage while maintaining a relatively low liquidation risk. This is mainly attributed to the strong correlation between the collateral tokens and the borrowable asset, which results in lower liquidation risks compared to other (less correlated) collateral and debt assets.

This further strengthens our conviction that this listing has the potential to catalyze activity within the Red Bank on Neutron.

Whitelisting LP token as collateral essentially increases the protocol’s total exposure for a single token. The current deposit cap for WETH.axl (200 tokens) is about 50% of the total on-chain liquidity on Astroport, which already exceeds the 30% maximum cap as per the Deposit Caps Risk Framework. However, currently the usage of this token on the Neutron outpost of the Red Bank is low (~3% of the cap at the time of writing this proposal).

Based on the above, we propose to decrease the deposit cap for an individual token from 200 to 100 WETH.axl in favor of listing more attractive strategies.

Technical and Centralization Risks

Technical and centralization risks related to WETH.axl and wstETH are explored in governance proposals [MRC-18] and [MRC-49], correspondingly.

Oracle Risk

Oracle risks related to pricing WETH.axl and wstETH and are provided in governance proposals [MRC-18] and [MRC-49], correspondingly.

Pricing LP tokens:

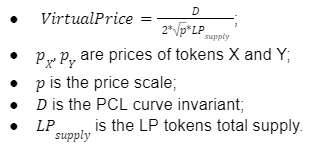

To determine the fair price of the LP tokens for Astroport PCL pool (wstETH/WETH.axl), the Mars Protocol oracle deploys the following fair LP token pricing implementation:

where

This implementation achieves the following:

- The price of the LP tokens is resistant to manipulation and flash loan attacks, because irrespectively of the current pool reserves, the LP token price is always calculated at the equilibrium point.

- The LP token price is calculated in a conservative manner because the pool’s TVL reaches minimum at the equilibrium point.

- When the oracle price is around the price scale, the LP token price is always conservative. When the oracle price deviates from the price scale, the real pool TVL may be slightly lower than the model one.

For the above reasons, we believe that the proposed implementation for pricing LP tokens for Astroport PCL pools is robust.

HLS-related Risks

The implementation of HLS comes with two new types of risk:

- Smart contract bugs: There’s always the possibility of unforeseen implementation bugs and smart contract vulnerabilities. The materialization of these risks could translate into loss of funds for users. While the code being used has been audited, this obviously doesn’t guarantee that it’s free from bugs. As such, we suggest caution when using this new feature, especially within the first months of its implementation.

- Risk parameter-related vulnerabilities: If the risk parameters are set too aggressively, the liquidations system might not work properly which could translate into protocol insolvency. While we believe the proposed parameters are conservative enough, users should always have this risk present when using the protocol.

- Higher leverage means a greater likelihood of liquidation, which poses risk to users of the HLSs and to the Mars system (risk of bad debt if liquidations do not occur as expected/desired).

Risk Parameters Suggestion

To apply the Risk Framework to determine the LTV for LP tokens, we calculate the average liquidation LTV for the underlying assets, adjust for impermanent loss risk, and finally calculate the max LTV by adjusting the liquidation LTV by the average safety margins of the underlying assets.

Following the methodology suggested by the Mars Risk Framework, we propose the following parameters:

LP tokens as collateral:

High Leverage Strategies:

Implementation

This is a signaling proposal, not an executable proposal.

The Mars smart contracts on the Neutron chain are currently controlled by the Builder Multisig address. If this proposal passes, the builders will utilize their multisig to make the necessary parameter changes.

Copyright

Copyright and related rights waived via CC0.

Disclaimers/Disclosures

This proposal is being made by Mars Protocol Foundation, a Cayman Islands foundation company. Mars Protocol Foundation engages in research and development of the Mars Protocol. Mars Protocol Foundation and certain of its service providers and managers own MARS tokens and have financial interests related to this proposal. The aforementioned persons or their affiliates may also have financial interests in complementary or competing projects or ecosystems, entities or tokens, including wstETH and WETH.axl. These statements are intended to disclose relevant facts and to help identify potential conflicts of interest, and should not be misconstrued as a complete description of all relevant interests or conflicts of interests; nor should they be construed as a recommendation to purchase or acquire any token or security.

This proposal is also subject to and qualified by the Mars Disclaimers/Disclosures. Mars Protocol Foundation may lack access to all relevant facts or may have failed to give appropriate weighting to available facts. Mars Protocol Foundation is not making any representation, warranty or guarantee regarding the accuracy or completeness of the statements herein, and Mars Protocol Foundation shall have no liability in the event of losses or damages ensuing from approval or rejection or other handling of the proposal. Each user and voter should undertake their own research and make their own independent interpretation and analysis of all relevant facts and issues to arrive at their own personal determinations of how to vote on the proposal.